Contents

Some borrowers may be lucky enough to get some. Be sure to explain to donors that the lender is merely complying with FHA requirements. FHA rules prohibit down-payment gifts from sellers.

According to the U.S. Department of Housing and urban development (hud), the FHA requires that the properties financed with its loan products meet the following minimum standards: Safety: The home should protect the health and safety of the occupants. Security: The home should protect the security.

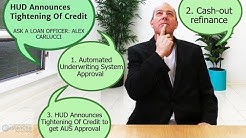

HUD announces new rules for down payment assistance on FHA mortgages – towards borrowers’ MRI are doing so consistent with FHA requirements.” As the FHA states in its mortgagee letter, the current.

Find out which mortgage is right for you: Comparing conventional, FHA and VA loans – The FHA allows borrowers to spend up to 57 percent of their income on monthly debt obligations, such as mortgage, credit.

Debt to Income Ratios for FHA Loans Qualifications for an FHA loan also take into consideration the borrower and co-borrower’s debt-to-income (DTI) ratio. There are specific requirements with regards to debt-to-income-ratios to help protect the buyer from being approved for a.

· Applicants must meet several FHA loan requirements. This includes providing documentation of a stable employment, income and credit history, and the ability to.

Fha Mortgage Insurance Premium Calculator What Do You Need to Qualify for a Mortgage? – How to calculate your debt-to-income ratio To. With a score between 500 and 579, you’ll need a 10% down payment. The FHA requires borrowers to pay a one-time up-front mortgage insurance premium.Fha Loan Condo Fha Mortgage Insurance Premium Calculator FHA borrowers have to pay two types of mortgage insurance premiums: annual and upfront. The upfront mortgage insurance premium is charged when you first get your mortgage, and the annual premium is an ongoing obligation you pay every year. Paying for fha mortgage insurance. The upfront mortgage insurance premium costs 1.75% of your loan amount.

What Is an FHA Loan and What Are Their Requirements? – Borrowers benefit from an FHA loan’s low-down-payment threshold of 3.5% of the total home purchase. Borrowers with FICO credit scores as low as 580 and bad credit can still meet FHA loan requirements.

fha loan rules: Borrowers, Co-Borrowers, Co-Signers – Do you know what the FHA loan rules are for borrowers, co-borrowers, and/or co-signers? What are the requirements for each and how is your lender required to proceed with each? The FHA home loan rule book for single family mortgages, reverse mortgages, and refinance loans is HUD 4000.1 It instructs the lender that borrowers have an occupancy requirement-the borrower must agree to take.

fha loan rules: Borrowers, Co-Borrowers, Co-Signers – Do you know what the FHA loan rules are for borrowers, co-borrowers, and/or co-signers? What are the requirements for each and how is your lender required to proceed with each? The FHA home loan rule book for single family mortgages, reverse mortgages, and refinance loans is HUD 4000.1 It instructs the lender that borrowers have an occupancy requirement-the borrower must agree to take.

FHA Loan Requirements | Get FHA Loan Requirements for 2019 – What are FHA Loan Requirements? If you would like to buy a home, but you don’t have a big down payment saved up, don’t worry because an FHA loan allows.

FHA Bankruptcy Guidelines 2019 – mortgage-world.com – In order to qualify for an FHA loan, the borrower must qualify financially, have re-established good credit, and have a stable job. FHA After Chapter 13 bankruptcy similarly fha will consider approving a borrower who is still paying on a Chapter 13 Bankruptcy if those payments have been satisfactorily made and verified for a period of one year.